Written and Edited by:

Bernard Quayson (Gelisem)- Tech Activist

What is E-levy?

The introduction of E-levy has been a headache for Ghanaians since the beginning of its implementation. But guess what? This is all you need to know in order to save yourself from these thinking stresses caused by the opinions of some Ghanaian folks and citizens.

Electronic Transaction Levy (commonly known as Electronic Levy or E-levy) is a tax applied on transactions made on electronic or digital platforms. (https://en.wikipedia.org/wiki/E-levy_(Ghana).

This means that; anytime there’s interaction and transactions between users on a software-based online infrastructure (digital marketplace), a fee is to be paid to the government for development. That is the only purpose for the so-called E-levy.

If that is the true meaning of the levy, then, why the fight? This question will be answered somewhere in the body of this paper, and you will know why we still remain politicians and not leaders. In case you didn’t know; those two words are not the same. Politicians are not leaders and leaders are not politicians. I have an ongoing white paper on politicians and leaders, so don’t be in a haste to argue. It will be published on bigtekbrains.com for your perusal.

Examples of Digital Marketplaces

For those of us who have gotten the chance to transact on a digital marketplace, you at least understand the basic principles of its operations. Let me name a few examples of the digital marketplace – for the sake of those who may not be aware. Some of the most prominent digital marketplaces are owned, designed, and operated by corporations such as Google, Amazon, Facebook, Alibaba, Netflix, YouTube, Tencent, Baidu, Yandex, online betting and gaming companies, and others in the e-commerce space.

So E-levy is targeted to tax every transaction made either with PayPal, Debit/Visa, MasterCard, Momo, etc., on these digital marketplaces.

Do we need E-levy?

The average growth rate of total government revenue and grants has fallen sharply, and this is lower than the GDP of the sub-Saharan average percentage, hence; it needs to be improved. But the question is: do we have a substitute for Domestic Resource Mobilisation (DRM)?

Domestic resource mobilization is the process through which countries accelerate growth by transparently raising, allocating, and spending their own funds to provide for their people (public services- including health). https://www.fpfinancingroadmap.org/learning/specific-topics/domestic-resource-mobilization.

Even if the government borrows to finance projects and programs, it will still need to mobilize revenue domestically to service and repay the debt. DRM is key to countrys’ ownership and ensuring sustainable financing for social services.

So the target is to raise funds from all sectors of the economy. Especially the service sector- – which has seen increased economic activity and is, rightly, viewed as having high revenue-generating potential. The service sector in the economy of Ghana covers a range of tertiary economic activities subdivided into transport, storage and communications, wholesale and retail trade, restaurants and hotels, finance, insurance, real estate, and business services. The service sector takes the lion’s share of GDP and employment. So it is only proper that the economic activity of this sector is properly examined and taxed and when properly applied, it will help government finance its development just, as any other tax revenue.

Targeted Informal sector

The government’s reason for the tax is that it wants to tax the incomes of Ghana’s large informal sector. According to the 2021 population and housing census, there are about 10 million workers in Ghana. Out of this number, 2.3 million Ghanaians work in the formal sector and they automatically pay personal income tax. The government finds it difficult to tax the incomes of the remaining 7.7 million workers in the informal sector.

In addition, the information and telecommunication sub-sector is one of the fastest-growing sub-sectors in the country. The majority of these sectors happen to operate informally.

To this effect, the Ghana government questioned all e-commerce and digital platforms that have no physical appearance in the country to file a tax return and pay monthly taxes just as local businesses do, before 1st April 2022. It warns that non-resident companies that fail to comply will be blocked from drawing payments from Ghana.

We should also understand that countries like South Africa, Algeria, Cameroon, Zimbabwe, Nigeria, and Kenya, have already laid out plans for the collection of taxes from digital companies.

The informal sector captures a large segment of the economic activities of most developing countries- activities which are outside the domain of regulated economic activities.

Statistics

The international labour organisation and the world trade organisation (2009) report that in developing countries, the informal sector accounts for, on average, 65% of employment, and 30% of output. In addition, according to Ghana Statistical Survey, (GSS, 2008), over 80% of those employed in Ghana are working in the informal sector. About 55.9% are self-employed, 20% work in family enterprises, and 18% are wage employees.

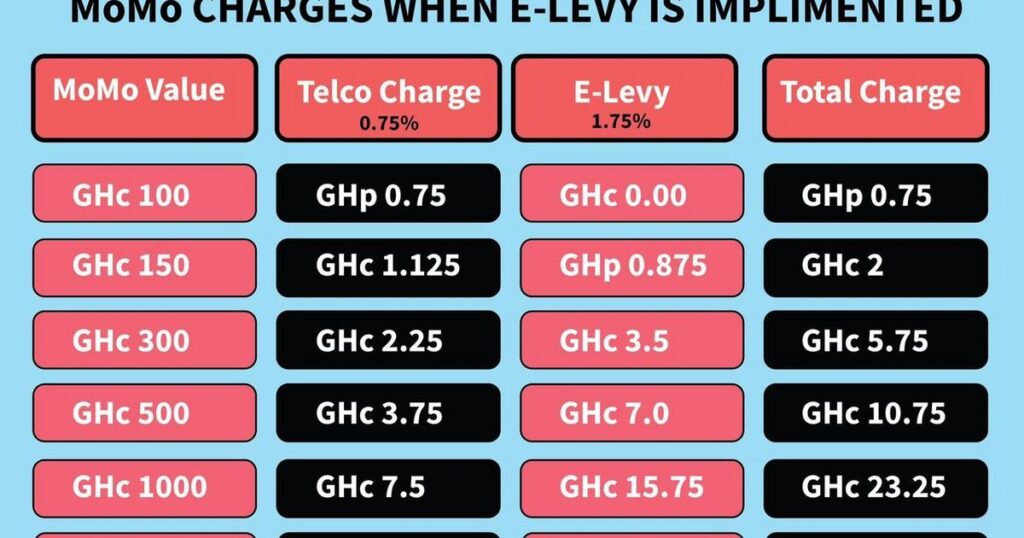

About E-levy charges on mobile money

E-levy mobile money requires a 1.5% tax debit from electronic transactions such as mobile money transfers, bank to bank transfers, bank to mobile money transfers, and online payment transactions with payment platforms such as Visa card, Master Card, PayPal etc.

- 1.5% tax will be debited from money transfers between accounts on the same electronic money issuer.

- 1.5% tax will be debited from money transfers from one account to a recipient on another account.

- 1.5% tax will be debited from money transfers from bank accounts to mobile money accounts.

- 1.5% tax will be debited from money transfers from mobile money accounts to bank accounts.

- 1.5% tax will be debited from bank transfers on a digital platform or application linked to a bank account belonging to an individual to another individual.

- E-Levy Charges will not apply to mobile money transfers of less than GH100 made per person per day.

- Withdrawals from mobile money accounts, on the other hand, will not be taxed.

- E-Levy Charges will not apply to mobile money transfers of less than GH100 made per person per day. All charges will be borne by the sender except in the case of inward remittances where the charge will be borne by the recipient.

NO REASON FOR THE FIGHT OVER E-LEVY

Taxes help to raise revenue. Governments must collect taxes to raise revenue and spend prudently with the hope that the positive government expenditure multiplier effect on Gross Domestic Product would outweigh the negative tax multiplier effect on GDP, with an overall positive effect on the GDP. Based on this principle, the e-levy will reduce disposable incomes, but when properly applied, it will help government finance its development just, like any other tax revenue.

The digital transaction is the world’s future. Because almost everything is going digital. The famous billionaire Bill Gates once said that the internet is becoming the town square of the global village of tomorrow, – and “if your business is not on the internet, your business will be out of model”.

My point is if E-levy is not allowed to be imposed and all traditional businesses start to go digital, how do we generate revenue to help government finance its development?

UNCDF, based on its market development approach, encourages stakeholders and industry players to explore tax policies that strike a balance between government priorities and the reactions the market might have. Best practices suggest that vulnerable groups should be put at the centre of such policymaking to leave no one behind in the digital era; broad consultations and public-private dialogue are needed to inform the action; weighted waivers could be considered to provide solutions that take into account user-profiles and transaction types.

The world is now moving to a point where money will not be controlled by any intermediary (Banks). Individuals can change asserts digitally without the activity of the bank (cryptocurrency). If we don’t strategize how to properly generate revenue from digital platforms, and cryptocurrency becomes the language of tomorrow, then its implications on the economy will be very disastrous.

Mobile money has made great strides in increasing access to digital financial services in Ghana and bridging the financial inclusion gap. By November 2021, Ghana had 47.3 million registered users, 18.4 active users and over GHs 80 billion (US$13 billion) value of mobile money transactions performed. Statistics also prove that digital transactions increase hugely every year. So we can imagine how much revenue can be generated from the informal sector.

E-levy can save the country if we all contribute as citizens and allow transparency and accountability, as we did to Covid-19 (regular updates). If the people see that their money is put to good use, they will pay, and pay more.

May God help us.

REFERENCE:

https://en.wikipedia.org/wiki/E-levy_(Ghana)

https://peacefmonline.com/ (Razak Kojo Opoku)

Your article helped me a lot, is there any more related content? Thanks!

Take a stroll